- /

- Blog

Best 10 Audit Software for Accountants in 2026

You probably don’t need another reminder that audit season is brutal - but here it is anyway.

In 2025 and beyond, accountants aren’t just crunching numbers. They’re expected to move faster, stay compliant, and do it all with fewer resources (and a talent crunch!).

Why Accountants Need AI Powered Audit Software

- 66% are already using AI in their day-to-day work: Our AI 2025 report found that 66% audit and finance professionals are already using AI to accelerate their work, almost half without the support of their leadership.

- Up to 90% error reduction: A European Journal study found that audit teams using AI tools reduced manual data-entry errors by as much as 90%.

- Reallocates accounting effort to higher‑value work: By automating repetitive tasks, accountants spend less time on data entry and reconciliations and more on strategic decision-making and risk analysis.

- Full‑population analysis, not just sampling: AI algorithms can flag patterns and anomalies across entire datasets, enabling full-population testing - eliminating limitations of manual sampling

- Increased digital investment across audit functions: Deloitte’s survey shows that audit leaders are prioritizing technology investments to modernize their functions.

Common Mistakes Using Audit Technology

Picking tech still feels like guessing on a multiple-choice test you didn’t study for, despite the surge of modern tools. Let’s face it – some tools aren’t helping you move faster, they’re just adding steps.

Underestimating Training Needs

Price-Only Decisions

Ignoring Integration and Compatibility

Poor integration with existing systems can create workflow disruptions. Accountants should focus on software that seamlessly integrates with tools they already use, like Excel, to ensure smooth data flow and reduce manual rework.

Overlooking Security and AI Ethics

Top 10 Best Audit Software in Accounting

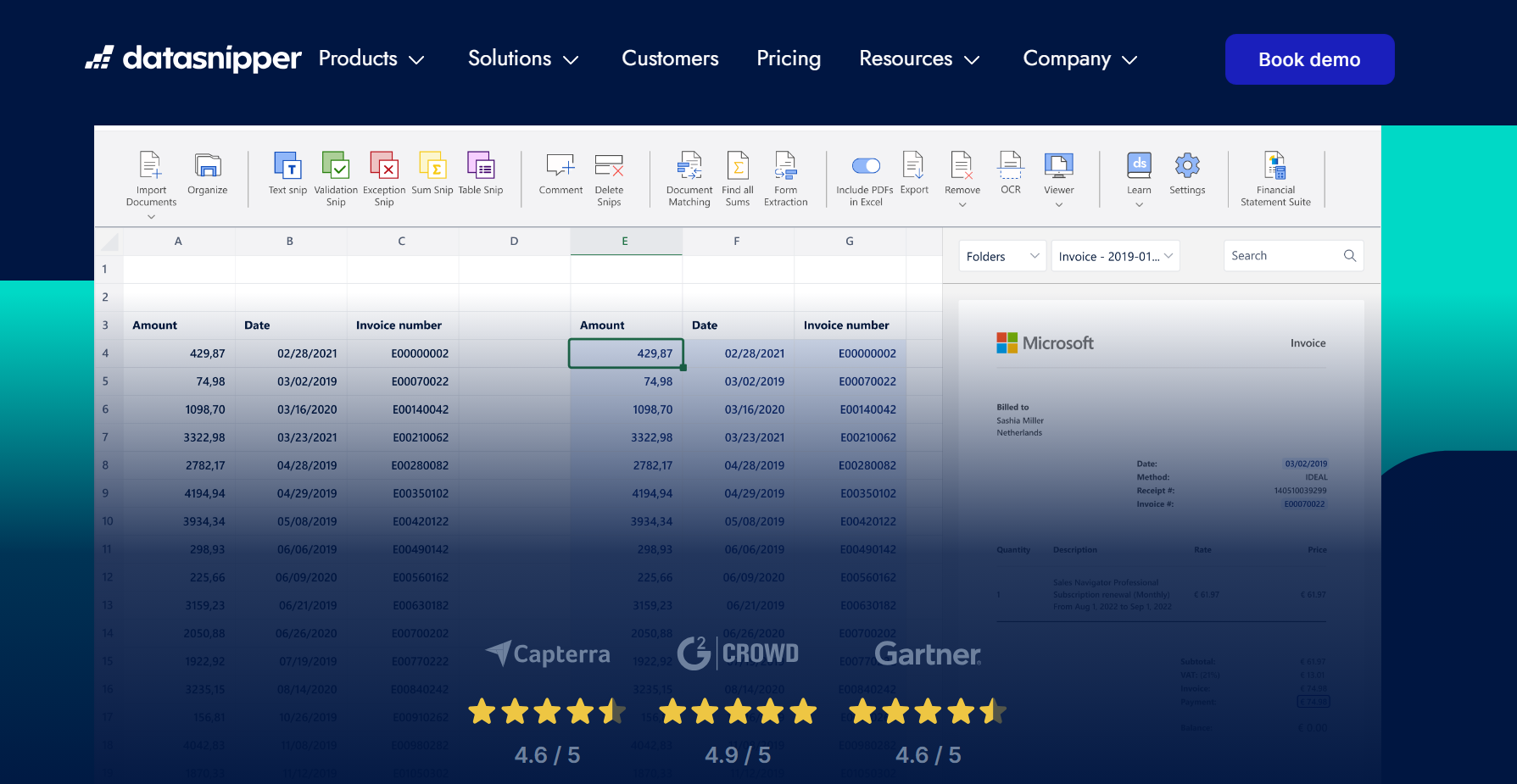

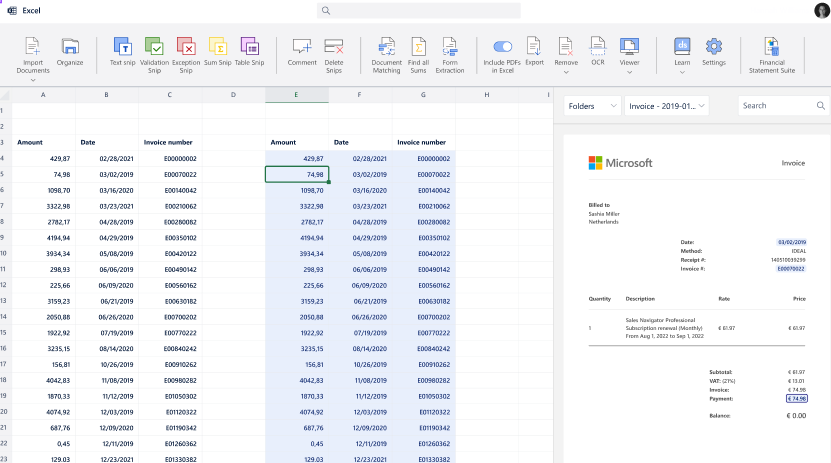

1. DataSnipper – AI Audit Automation Platform

Ideal for: External and internal audit, tax, advisory, and government audits.

Website: https://www.datasnipper.com/

Trusted by Big Four firms like Deloitte, EY, and KPMG, and 600k+ users worldwide, the platform brings AI-powered efficiency to even the most complex audit engagements.

With features like automatic evidence matching, intelligent OCR, and smart cross-referencing, DataSnipper makes it easy to perform Tests of Details, walk-throughs, control testing, and tie-outs - all without leaving Excel.

Key Features:

- AI-driven automatic audit evidence matching

- Intelligent OCR and automated cross referencing within Excel

- Financial Statement Suite(FSS): Integrated tick marking, validation and checking mathematical accuracy

- Data-extraction from structured or unstructured documents

- UpLink: Streamlined PBC request management and client collaboration

Accountants rely on it to:

- Perform ToDs, payroll testing, batch payments, AR cut-off, and cash confirmation procedures

- Document Tests of Controls and walkthroughs with consistent referencing

- Reconcile trial balances, document financial statement procedures, and review 10-Ks using FSS and more

“DataSnipper provides major efficiency improvements and is offering features that truly support our teams in delivering a high-quality audit. On top of that, DataSnipper is fun to use!” Mathias Bunge, Partner FSI Audit & Assurance, Deloitte

2. Onspring

Ideal for: Firms needing streamlined compliance and risk management

Website: http://www.onspring.com

Onspring is a cloud-based platform designed to support accountants throughout the audit process, offering customizable workflows and real-time tracking. It’s particularly beneficial for firms handling a variety of audit and compliance tasks, allowing them to streamline and automate workflows while ensuring data integrity and audit trails.

Accountants may use it to:

- Efficiently manage audit workflows with automated task handling

- Ensure compliance with regulatory standards across multiple departments

- Monitor and track audit progress with real-time dashboards and reporting

- Securely collaborate with internal teams and external clients using role-based access

3. Diligent HighBond – AI-Enhanced Governance & Compliance

Ideal for: Firms with internal audit and GRC overlap

Website: http://www.diligent.com/highbond

HighBond (formerly Diligent One) brings together audit planning, risk assessment, and compliance workflows with AI-driven insights. It enables risk-based audit alignment, automated evidence collection, remediation tracking, and centralized dashboards for governance teams.

It brings audit, risk, and compliance onto one platform.

Accountants use it to:

- Risk-based and continuous audit management with real-time monitoring to align audit efforts to highest-priority risks

- Workpapers management and evidence tracking, including remediation workflows and global issue oversight across audit engagements

- Pre-configured audit templates and robotics toolkits to streamline repetitive audit tasks and control testing activities

4. Inflo – Digital Audit Platform for Accounting Professionals

Ideal for: Firms transitioning to a digital-first audit approach.

Website: http://www.inflo.io

Inflo offers a comprehensive digital audit platform that combines automation, AI, and analytics. It provides tools for data analytics, client collaboration, and quality management, enabling firms to enhance audit efficiency and effectiveness.

Accountants benefit from:

- Automates audit processes with advanced analytics and AI, enhancing audit quality.

- Provides real-time insights and visualization tools for better decision-making.

- Seamlessly integrates with accounting systems to ensure smooth data flow and improved accuracy.

- Helps accountants shift from traditional audit work to more value-added advisory roles.

5. ASD Audit – Comprehensive Audit Management Solution

Ideal for: Firms looking for a scalable audit management solution across various audit types.

Website: https://www.asdaudit.com/en/

ASD Audit is a complete audit software solution that integrates all audit management functions into a unified platform. The tool supports auditors in managing the entire audit lifecycle - from planning to reporting and follow-up - ensuring full control over the process.

Accountants use it to:

- Manage multiple audit engagements with custom workflows and templates

- Automate risk assessments, audit planning, and document management

- Streamline collaboration with team members and clients in real-time

- Maintain compliance with regulations through automated audit trails and detailed reporting

6. AuditBoard – Enterprise Risk and Compliance Solution

Ideal for: Mid-to-large firms requiring an integrated platform for audit, risk, compliance, and ESG workflows.

Website: http://www.auditboard.com

AuditBoard is a cloud-native platform that consolidates audit, risk, compliance, and ESG workflows. Offering AI-powered documentation, automated compliance reports, and real-time dashboards, it drives proactive risk management. The platform unifies audit, risk, and ESG under a cloud interface.

Accountants use it to:

- Comprehensive risk management and audit trail management

- Utilize AI to automate manual tasks, such as report generation and data analysis, allowing teams to focus on strategic decision-making.

- Access intuitive dashboards that provide clear visibility into audit progress, risk assessments, and compliance status.

- Tailor workflows to meet specific organizational needs, ensuring flexibility and adaptability in audit processes.

7. MindBridge AI – Intelligent Auditing and Data Analytics

Ideal for: Audit teams in need of data-driven insights and anomaly detection.

Website: http://www.mindbridge.ai

MindBridge AI uses artificial intelligence to transform the auditing process by automating data analysis and identifying anomalies that could indicate financial risks. The platform applies machine learning to analyze entire datasets, offering auditors a comprehensive view of their clients’ financial health.

Accountants benefit from:

- AI-driven anomaly detection that highlights outliers and potential risks within financial data.

- Automatically analyzes financial data to identify outliers, risks, and potential fraud without the need for manual sampling.

- Reviews entire datasets (not just samples) to provide a complete picture of financial health, enhancing audit accuracy.

- Uses AI to score transactions based on their risk level, helping accountants prioritize high-risk areas for further investigation.

8. Thomson Reuters Checkpoint Tools – CPA-Specific AI Compliance

Ideal for: CPA firms needing compliance guidance

Website: http://www.tax.thomsonreuters.com/checkpoint/

Checkpoint Tools for PPC is a suite of Microsoft Word and Excel-based templates -covering workpapers, practice aids, disclosure checklists, and engagement letters. These resources are regularly updated and integrated into virtual office or desktop environments, providing trusted, AI-enhanced references for compliance tasks.

The platform now offers AI-enhanced guidance that accelerates regulatory and financial-statement preparation.

Accountants rely on it because:

- Automates regulatory and compliance checks

- AI-enhanced tax and financial statement preparation

- Operates within Word and Excel, preserving familiar tools while enhancing with smart suggestions.

9. Intelex – EHS and Risk Audit Automation

Ideal for: Accountants in industrial, environmental, or regulated sectors

Website: http://www.intelex.com

Intelex is an EHSQ (Environmental, Health, Safety, Quality) platform that centralizes audit scheduling, data capture, reporting, and compliance tracking across operations. With mobile capabilities, users can collect photos, geotags, incident data onsite, and dashboards offer real-time insights into EHS performance and audit outcomes.

Accountants benefit from:

- AI-driven templates for environmental, health, and safety audits

- Audit scheduling and task automation with customizable workflows and checklists

- Mobile-enabled, real-time data capture lets auditors collect photos, geotags, and findings onsite

- Standardized workflows and dashboards enhance traceability and simplify reporting

10. SAP Audit Management – Large-Scale ERP Integration

Ideal for: Large enterprises or accountants embedded in SAP environments

Website: http://www.sap.com/

SAP Audit Management integrates deeply with SAP ERP to offer embedded audit planning, risk control testing, issue tracking, and AI-led insight generation. Its centralized dashboards link audit findings to business processes, while mobile apps support onsite inspections and follow-up via SAP workflow channels (citation for SAP features not extracted but consistent with product knowledge).

Accountants benefit from:

- Full audit lifecycle coverage: planning, preparation, execution, reporting, follow-up

- AI-driven audit planning and risk controls

- Seamless ERP integration

- Mobile-enabled working paper documentation via drag‑and‑drop tools

FAQ:

What is audit software used for in accounting?

Audit software helps accountants automate and manage the audit process, from planning and evidence collection to documentation and reporting. It reduces manual work, improves compliance, and enhances accuracy through automation and AI.

How is audit software different for accountants vs. auditors?

Audit software for accountants focuses on financial reporting, reconciliations, tax compliance, and client deliverables. For internal auditors, software emphasizes risk assessments, operational controls, fraud detection, and compliance monitoring.

Can audit software integrate with Excel?

Can DataSnipper save time for accounting firms during audits?

Yes. DataSnipper helps accounting teams save hours on audit tasks by automating data extraction, cross-referencing, and documentation.

What audit procedures can accountants perform with DataSnipper in Excel?

Accountants can use DataSnipper for a full range of external audit tasks. This includes tests of details like payroll and revenue, walkthrough documentation, inventory validation, and financial statement tie-outs. The platform automates matching, annotations, and audit evidence linking without switching platforms.